Is Shareholder Activism The Cure For The Common Stock

Shareholder activism and company responses to it have changed considerably since Benjamin Graham launched his shareholder activism engagement at Northern Pipe Line Co. in 1926. Also, the number of companies targeted by an activist investor has risen significantly over the past years while shareholder activism in all its forms and myriad strategies continues to spread to new international territories. And with investment returns consistently outperforming the average hedge fund, a growing number of asset managers are poised to follow the lead of famous activist investors, such as Carl Icahn, Nelson Peltz, Bill Ackman and Dan Loeb, in their pursuit to create shareholder value.

Critics of shareholder activism argue that activist investor strategies foster short-termism by preventing corporate management from making long-term investments needed for sustainable growth. While it is true that activist investors like quick returns, this is an actuality that applies to all institutional investors. The quicker the return on a realized investment, the higher the Internal Rate of Return (IRR) and the faster the investment funds can be re-invested for subsequent gains. But just because activist investors understand basic IRR math does not mean that quick short-term results are the sole objective of their investment decisions.

Quite to the contrary, if share prices are supposed to reflect the discounted present value of a company’s future income stream, which incorporates the market’s best guess as to the future value of a company’s shares, the market would deliberately factor in any activist induced short-termism by heavily discounting all future earnings estimates. Put another way, the share price of the target company would decrease, reflecting the market’s expectation that the company’s future prospects and profitability will be bound to take a turn for the worse.

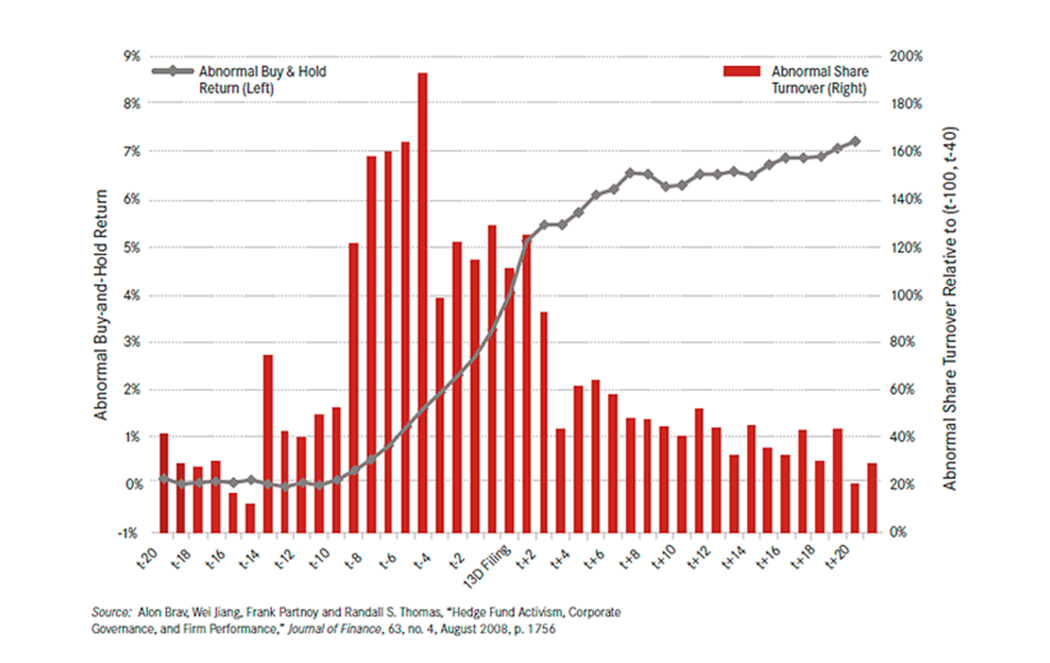

With that in mind, a recent study by Lucian Bebchuk, Alon Brav, and Wei Jiang, discovered that save for a few exceptions, the target companies’ valuations, including return on assets and operating performance, improved in the five-year period following an activist engagement. Moreover, three years after the partial or full cashing out of an activist investor’s investment, long-term shareholders continued to have positive returns.

Shareholder Activism & Activist Investors

The reality is many activist investors advocate strategies that require substantial time to implement. In addition, most activist investors understand that time frames can be fickle and prone to change between an initial proposal for a change at the target company and the actual acceptance and implementation of the change by management. Hence, a significant number of activist investors undertake investments with durations measured in years, not months.

Moreover, to successfully engage, activist investors need to persuade other investors to support their plan for corporate change seeing that the majority of activist investors are minority shareholder, holding a small percentage of a company’s shares while the greater part is owned by institutional investors. Without their vote, any shareholder activism engagement would be short-lived.

While poor capital allocation decisions by target companies may have been a key driver behind many shareholder activism engagements in the recent past, dividend payout and share buyback strategies are bound to lose their appeal in the face of significant appreciation in stock market valuations. In light of this, activist engagements are becoming increasingly more sophisticated in scope and strategy. Unfortunately, the prevailing wisdom of target companies is that dealing with an activist investor is like running an election campaign. And like election campaigns, proxy contests have a long history of demonstrating the value of negative campaigning.

In short, if the mere mention of an activist investor compels you to fire up the torches, seize the pitchforks, and man the perimeter, it is high time to take into account that creating shareholder value in the short-term should not in itself be reason enough to condemn shareholder activism outright as long as the strategies laid out by the activist investor do not destroy more value in the long-term for the sake of short-term gains.

After all, this type of ‘hit-and-run’ activism investment would not be in the interest of any investor with a long-term investment horizon, least of all institutional investors such as mutual and pension funds with the sway to make or break a shareholder activist campaign.

Related Articles