Activist Investor Definition

What Is An Activist Investor?

The activist investor definition and the term activist shareholder defines an individual investor or institutional investor, such as an activist hedge fund, that purchases a non-controlling minority stake of the voting class of a public company’s equity securities to effect changes within the target company.

Activist investors do not own, control or manage the corporations in which they invest. Instead, they rely on the support of institutional investors and pension funds to exert influence and exercise their shareholder rights.

In the United States, activists must disclose their activist stake by filing a Schedule 13D with the U.S. Securities and Exchange Commission (SEC). This requirement is triggered whenever an activist investment passes the 5% threshold of the voting class of a company’s shares.

Activist Strategies

No other turn of events has shaped public companies’ operational and financial decision-making as thoroughly as the rise in shareholder activism and activist investing strategies in the wake of the global financial crisis of 2008.

Notable activist investors, such as Carl Icahn and Nelson Peltz, have been remarkably successful in agitating for change at a number of high-profile activist targets in recent years. In 2014, a total of 344 companies worldwide were targeted by activists, up 18% from the 291 recorded in 2013, according to a report by Activist Insight, causing shake-ups at big corporate names that resulted in 75% of activist demands being at least partially satisfied, up from 67% in 2013.

Whenever the CEOs and management of public companies lack appropriate incentives to maximize shareholder value, good corporate governance becomes essential. Without it, managers run the risk of maintaining their position regardless of performance while receiving excessive executive compensation and depleting free cash flow on value-reducing acquisitions.

Moreover, evidence shows that large pension and mutual funds tend to be ineffective monitors of corporate governance issues due to conflicts of interest and reputational risks.

Activists and activist hedge funds, on the other hand, are unique in that they maintain more concentrated portfolios and are subject to fewer reputational risks and regulatory constraints. This permits the activist investor to function as an important intermediary in global equity markets by driving sustained improvements in operating performance and shareholder value at public companies.

What Is Activist Investing?

Even though hedge fund activism and activist investor strategies have transformed in recent years, the primary activist themes remain the same and can be categorized as follows:

- Underperformance: The target company has underperformed relative to its industry peers or the broader stock market.

- Capital Efficiency: The target company has a sub-par capital allocation and is either under-levered or has excess liquidity that can be returned to shareholders in the form of dividends and share buybacks.

- Corporate Governance: The target company has significant corporate governance obstacles such as a captive Board of Directors, dual-class share structures, poison pills and other factors that preclude shareholders to prompt for change.

- Strategic Redirection: The target company has assets that are undervalued by the market or no longer fit within the overall corporate strategy. A strategic redirection will free up the company to divest or spin-off subsidiaries, thereby creating more focused entities that are properly valued by the market.

- Corporate Initiatives: The target company has put itself up for sale without seeking an adequate premium for shareholders due to leadership’s severance and change-in-control agreements (i.e. Golden Parachutes).

These activist engagement themes, while broad in scope, provide a general direction for most activist investor strategies. Although activist strategies will include many different proposals that are likely to touch on many different themes, the activist investor strategies tend to aim at bringing more rigor to target companies and engaging passive institutional investors.

Activist Investor Tactics

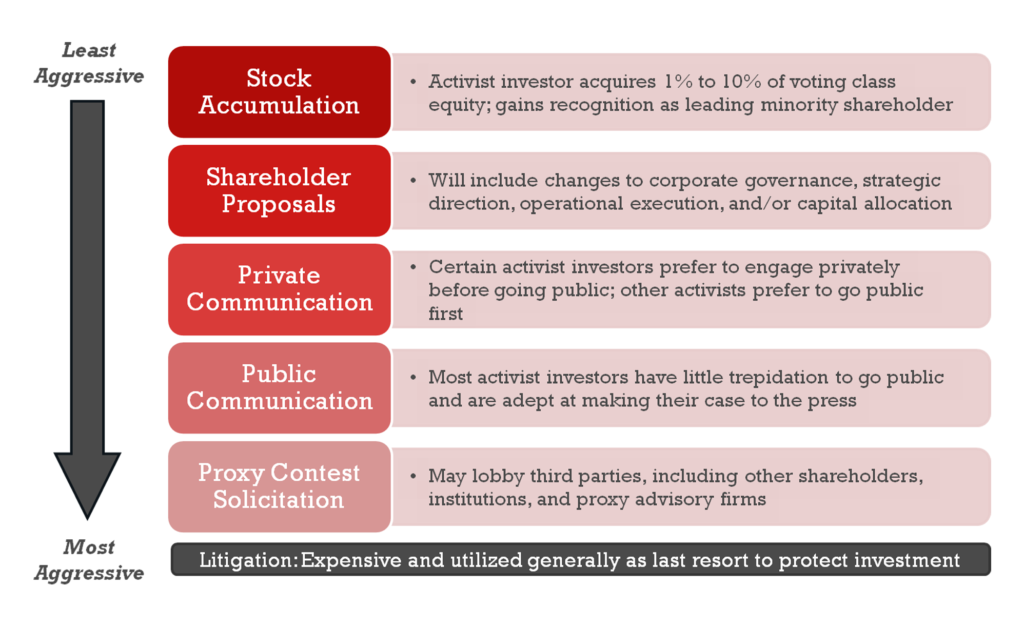

Activist investor tactics are relatively diverse and range from collaborative to contentious, including negotiations with management, public campaigns, shareholder resolutions, proxy contests, and litigation.

While high-profile activist campaigns garner the most attention and despite how activists are portrayed by embattled management teams, many activists prefer to approach companies privately in an effort to address the issues in a collaborative manner. Nonetheless, in certain instances, activist investor tactics will incorporate steps to put pressure on target companies prior to escalating the activist engagement:

- Private negotiation with management without publicly disclosed activism

- Publicly disclosed activism with letter and presentation to management

- Publicly disclosed activism with letter to shareholders

- Proxy fight and shareholder vote

- Shareholder litigation over shareholder proposals and stockholder appraisal rights

- Unsolicited offer or takeover

Due to the financial expenses and the time associated with launching a proxy contest and pursuing litigation, relatively few activist investor campaigns proceed past letters and presentations to a company’s management and board. This is also true for target companies that increasingly seek an amicable settlement in an effort to avoid a contentious battle in light of the changing attitudes of institutional investors and proxy advisors.

Famous Activist Investors

Carl Icahn is still arguably one of the most famous activist investors within a select list of top activists and corporate governance zealots. Over the years, the notable billionaire investor has established a successful shareholder activism track record with publicly traded companies, pushing CEOs and engaging boards in an effort to increase the stock price and shareholder value of undervalued enterprises. Still, a question worth asking is how these agitators manage to exert so much influence over some of the biggest corporations in the world and whether shareholder activism is good or bad for companies?

The answer varies depending on the activist and how they choose to engage the CEO and shareholders after building an equity stake in a target company.

More than just famous activists, the following six investors focus on operational excellence that goes beyond sheer value arbitrage and capital allocation improvements, such as dividend policies and share buybacks. This overview contains information from publicly available sources, including Schedule 13D filings, proxy materials, and investor communications.

Carl Icahn, Icahn Enterprises

Carl Icahn is the founder of Icahn Associates and majority shareholder of Icahn Enterprises, a diversified conglomerate holding company. His mere presence and disclosure of a new stake can cause an upward bounce in the share price of beleaguered stocks through the so-called “Icahn Lift”.

Icahn’s activist investments include Dell, Clorox (NYSE: CLX), CVR Energy (NYSE: CVI), eBay (NASDAQ: EBAY), and Apple (NASDAQ: AAPL).

Nelson Peltz, Trian Fund Management

Nelson Peltz was an activist investor long before the term shareholder activism was popular. And while his corporate targets have grown in size, his focus has remained the same: Cut costs and boost sales. Since co-founding Trian Fund Management in 2005, he has faced only two proxy contests to gain board representation. The first was in 2006, when Heinz opposed his proposed slate of five new directors. The second was in 2015, when DuPont (NYSE: DD) opposed his proposed slate of four new directors.

Trian’s activist investments include GE (NYSE: GE), Pentair (NYSE: PNR), PepsiCo (NYSE: PEP), Sysco (NYSE: SYY), and Mondelēz (NASDAQ: MDLZ).

Bill Ackman, Pershing Square Capital Management

Bill Ackman is one of the most famous hedge fund activists in the world. Not one to shy away from controversy, he has received a lot of negative attention due to his short position in Herbalife (NYSE: HLF) and his involvement in Valeant’s (NYSE: VRX) failed takeover bid of Allergan (NYSE: AGN). His firm, Pershing Square Capital Management, manages a highly concentrated multi-billion dollar portfolio that takes large stakes in a small number of companies, often accompanied by Ackman’s demands for corporate changes.

Pershing Square’s activist investments include Chipotle (NYSE: CMG), Restaurant Brands (NYSE: QSR), Canadian Pacific (NYSE: CP), and Wendy’s (NASDAQ: WEN).

Jeff Ubben, ValueAct Capital Management

Jeff Ubben is the CEO of ValueAct Capital Management, the San Francisco-based hedge fund that has quickly made a name for itself as a quiet instigator at the forefront of activist investing. The firm, which has targeted more than 75 companies as of 2016, invests in — and turns around — undervalued companies. In many ways, the investment style can be likened to bringing a private equity strategy to a public company.

ValueAct’s activist investments include Valeant, Morgan Stanley (NYSE: MS), Microsoft (NASDAQ: MSFT), and Adobe Systems (NASDAQ: ADBE).

Dan Loeb, Third Point

Dan Loeb is the CEO of Third Point, one of the largest event-driven hedge funds in the world. As a result, his firm’s holdings incorporate both activist investing as well as merger and risk arbitrage. Loeb’s preferred strategy is to acquire shares in troubled companies, replace inefficient management, and return the companies to profitability. One of his signature tactics involves the use of florid public letters to management while engaging shareholders.

Third Point’s activist investments include Dow Chemical (NYSE: DOW), Sotheby’s (NYSE: BID), Ligand Pharmaceuticals (NASDAQ: LGND), Fanuc, and Sony.

Jeff Smith, Starboard Value

Jeff Smith is the CEO of New York-based Starboard Value. The firm was spun off from the global alternative investment manager Ramius in 2011. While Smith is not yet as well-known as some of the more high-profile activists, his star is rising. In 2014, he succeeded in ousting the entire board of Darden Restaurants (NYSE: DRI) after a contentious campaign marked memorably by a nearly 300-page presentation that castigated the company for a host of sins, including not salting the water in which it cooked pasta and profligate breadstick distribution.

Starboard’s activist investments include Yahoo (NASDAQ: YHOO), Perrigo (NYSE: PRGO), Macy’s (NYSE: M), and Office Depot (NASDAQ: ODP).

Activist Investor & Social Media

Activist funds and activist shareholders are increasingly using online platforms to engage and make their case for constructive dialogue. The importance of social media as an interactive platform for activist investors dates back to 2007 when an individual activist investor launched an online engagement at Yahoo which ultimately resulted in the company’s then CEO to resign.

The new normal for a growing number of public companies is active use of social media to live-tweet quarterly earnings calls, share YouTube video messages from leadership and post corporate blog updates to amplify annual meetings. Some of the more prevalent online engagements currently pursued by both the activist investor and the target companies include the following:

- Dedicated Campaign Websites: A growing number of activist investors utilize websites to blog and publicize issue-specific information to their fellow shareholders when contemplating or pursuing a proxy contest as it is crucial to address all the existent corporate issues in detail. As a result, both the activist investor and the target company engage and share their own perspectives with analysts, investors and journalists through special campaign websites.

- Issue-Specific Visual Content: No longer are PowerPoint presentations and letters the sole medium of shareholder communication. Social platforms such as Twitter, Facebook and LinkedIn have emerged as key platforms for the sharing of infographics and visual content that can often make a more compelling case for improvements in capital allocation, corporate governance and overall business strategy.

- Cross-Channel Amplification: The activist investor and target companies amplify their message across an increasing number of social platforms that go beyond Twitter, Facebook, LinkedIn and YouTube. Due to the popularity of new communication platforms, online amplification has established itself as a key factor in driving both traffic and engagement back to campaign websites.

It is expected that social sharing and communication tied to activist investing will continue to increase in the future. If the past is any indication, activist investor funds will seek to remain innovative with their digital communications strategies and investor engagement approaches moving forward.

Activist Investors On Twitter

Twitter has a long-established record as the go-to communication platform for breaking, real-time news and information.

The appeal of the platform’s growing reach and real-time impact has already prompted a few shareholder activists, including Carl Icahn (@Carl_C_Icahn), to present their views and respond promptly to criticism through their personal accounts.

Since many more activists are likely to establish an active presence on the social network in 2016, we encourage your to subscribe to our Twitter lists to follow new activist investor resources as they continue to emerge:

- Investors: Personal accounts of shareholder activists and activist hedge fund managers

- News: Personal accounts of journalists covering activist hedge funds

- Research: Business accounts covering the issues that influence activist investments

Time will show whether the level of shareholder engagement will continue to increase as institutional investors become more involved in activism and more supportive of activism as a catalyst to bring to light potential shareholder value creation opportunities.

Although historically these investors have preferred to avoid supporting an activist investor directly, in today’s corporate environment there seems to be a distinct decrease in the number of “management-friendly” investors that were the norm only a few years ago despite the ongoing debates about reducing shareholder rights.